Profit Accounting

The support you need to build

Work with the Expert, Not the Apprentice.

You get direct access to me, no junior staff, no offshore teams,

just senior-level advice.

In Hawkes Bay?

Let’s discuss your business over a coffee. My treat.

Frequently Asked Questions

What makes 'Profit Accounting' different from a traditional accountant?

When you hire a traditional firm, you often pay for a brand name & expensive offices but get a junior accountant looking at last year’s numbers. They tell you the score after the game is already over.

At Profit Accounting, you get me, your dedicated financial partner.

I work with business owners who are tired of surprise tax bills and unpredictable cash flow. While I handle the necessary compliance work with precision, my focus is on your future. I help you:

-

- Stop guessing about your finances.

- Structure your cash flow for permanent growth

- Navigate the road ahead with clear, forward-looking advice.

You can hire a historian to record the past, or you can hire a partner to help you design a wealthy future.

Do you outsource work offshore like other accountants?

No, I personally do all my client work in order to stay up to date about what’s happening in my clients businesses and to ensure accuracy and correctness of my work. Many accountants outsource their work offshore to improve profit margins by taking advantage of the lower labour cost in countries such as India & Malaysia.

Do you have receptionists and junior staff I'll be passed to?

No, you’ll always work directly with me, a fully qualified accountant, and have my personal email address and mobile number should you have any questions. You won’t be passed around between junior staff members or admin staff every time you call or email.

Your services sound valuable, but I'm worried about the cost. What are your fees?

I understand that cost is a major consideration. That’s why I don’t use the traditional hourly billing model, which can lead to surprise invoices. All my services are provided on a fixed-price monthly subscription, so you have complete certainty over your investment. I don’t charge for every email and phone call like other accountants, so you’ll never have to worry about asking a quick question. I work from my home office, so I don’t have expensive overheads and staff costs that are built into your fee.

I see myself as an investment in your profitability, not an expense. Because my packages are tailored to each client’s specific needs, the first step is a complimentary discovery call where I can provide a detailed, no-obligation proposal for you.

I already have an accountant. How does the switching process work?

It’s far easier and smoother than you might think. The process is professional, respectful, and I handle 100% of it for you. Once you decide to move forward, I simply send a standard clearance letter to your previous accountant to get your historical files. You don’t need to have any awkward conversations, I take care of the entire handover.

Hi, I'm Johnny

Why trust me with your business?

I don’t just have a Masters degree in Accounting; I have a quarter-century of real-world results. I combine the safety of a forensic accountant with the vision of a strategic advisor.

-

25+ Years Experience: Deep expertise in tax strategy and business advisory.

-

Corporate Level Insight: Former Financial Controller and Analyst for major Hawke’s Bay companies.

-

Forensic Precision: Specialized background in forensic accounting means I spot what others miss.

-

Small Business Focus: 15+ years running my own practice, so I understand the challenges you face every day.

Schedule A FREE Online Consultation

No matter where you’re located, I can help you build the business you want. Use the calender to book a FREE consultation & get a quote for my services. There’s no obligation and no strings attached. The purpose would be to gather information on your specific needs and to determine which services would be best suited to your specific business.

My fees are very affordable, and you get expert accounting knowledge and support behind your business. I quote each business only for what they need, so you don’t pay for unnecessary services.

I will quote a fixed fee for the year based on your specific needs, which I will then spread over a 12 month period, so you’ll know exactly how much, and what you are paying for every month.

If you’re in the Hastings/Napier area, feel free to specify a coffee shop and we can meet over a coffee.

Services

Every business is different, and so are its accounting needs. That’s why I offer tailored services designed to save you time, keep you compliant, and help your business grow. Whether you need help with tax returns, bookkeeping, payroll, or strategic advice, I’m here to make the numbers work for you, not against you. Take a look at how I can support you at every stage of your business journey.

Bookkeeping

Business Valuations

Accounting

Cash Flow Management

Tax

Management Reporting

Payroll

Outsourced CFO Advisory

How Do I Know If I Need an Accountant?

You started your business to do what you love—not to wrestle with spreadsheets.

Running a business means wearing ten different hats: marketing, operations, sales, and HR. Trying to juggle complex tax compliance and cash flow on top of that is a recipe for burnout.

If you’re unsure if you are doing things “by the book,” or if you’re staying up late worrying about tax bills, it’s time to hand over the reins.

Whether you are a tradie, freelancer, landlord, or small business owner, I don’t just keep you compliant, I give you your time back. Let me handle the numbers so you can focus on making money.

What is an Accountant?

An accountant is a financial professional who helps individuals and businesses manage money, stay compliant with tax laws, and make informed decisions. They handle things like bookkeeping, tax returns, business advice, and financial reporting.

When Should I Hire An Accountant?

If you’re starting a business, growing fast, unsure about tax, or want to free up your time, now is the right time. Don’t wait until you’re stressed or facing an IRD issue, getting the right help early can save you thousands down the track.

Can't I Just Use Accounting Software?

Accounting software is a tool, but like any tool, it’s only as good as the person using it. An accountant knows how to interpret the numbers, give strategic advice, and make sure you’re not missing out on deductions or risking penalties. We know the reporting framework, accounting rules and tax laws that apply to every business structure.

Latest Insights

Does your business idea have wings? 5 steps for starting a business

When a great business idea pops into your head, it could mark the start of a whole new enterprise. But how do you know if your business has what it takes to conquer the market? The key is to set the right foundations for nurturing your fledgling business – and that...

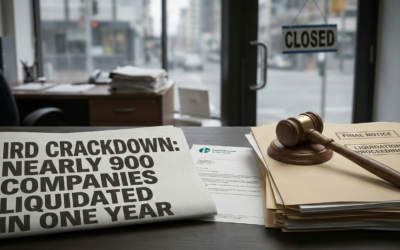

The Taxman Comes Knocking

Why Inland Revenue Liquidated Nearly 900 Companies This Year If you’ve been sensing a shift in the business climate lately, you aren’t imagining things. Inland Revenue (IR) has officially taken the gloves off. According to a new report from RNZ, the tax department has...

Merry Christmas

Wrapping up the year + When I’ll be back 🎄 I can’t believe we are already at the end of the year! Before I sign off for 2025, I wanted to send a quick note to say thank you & Merry Christmas. Whether you’ve been a long-time client or just joined my newsletter...